About me

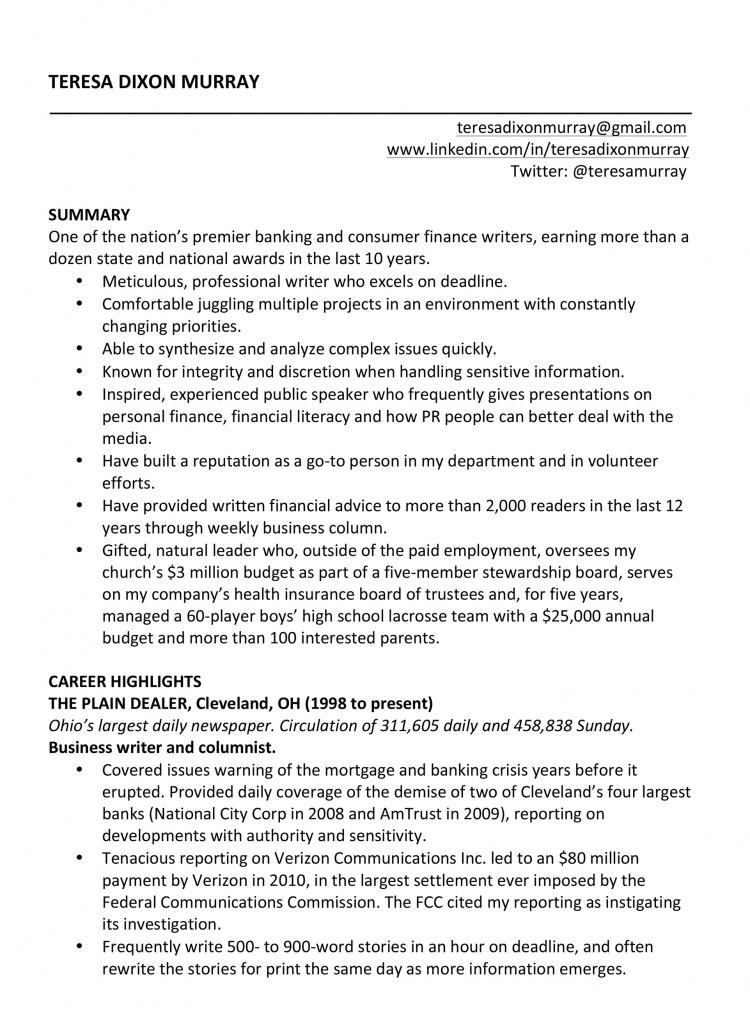

One of the nation’s premier banking and consumer finance writers, earning more than a dozen state and national awards in the last 10 years. Consultant on issues including financial literacy, mortgage and credit scores.***

Love helping people feel empowered to handle their money. Homer for CLE, Buckeye sports. Proud Ohio State University mom.Portfolio

Retiring KeyBank Foundation CEO Margot Copeland leaves legacy of transformed lives in Cleveland, nationwide

Margot James Copeland was 24 years old living in a small apartment in Bedford Heights, had been out of college for only two years and was working for Xerox. She had a simple prayer: “Lord, please put me in a role where I can help somebody.”

There were lots of somebodies. More than 40 years later, Copeland retired last week as a top executive at KeyBank and a career of helping — conservatively — tens of thousands of people.

Steve Steinour’s big gamble at Huntington: forgo tens of millions in revenue to win customers

Six years ago, Cornel Mentler’s world was collapsing.

As owner of Specialty Fitters, an Elyria manufacturer of piping for buildings, Mentler watched his sales fall from $4 million to $2 million a year as the economy sank. He was forced to lay off half of his 20 workers. He cut his own pay. Then his bank pulled his credit line, even though he’d never been late on a payment. He thought he may have to close the business he founded in 1996. “I was scared to death,” Mentler said.

Then another bank, Huntington, offered to give him the credit line he needed, even though his sales had been sour for the last two years. That saved the company. Specialty Fitters has since grown back to $4 million in sales and rehired seven workers. Life is good.

Taking chances on small businesses when the economy was lousy is just one of the unconventional strategies Huntington has adopted in the last seven years under Chairman and CEO Steve Steinour.

Those dreaded robocalls: An end may be in sight

Teri Dew of Cleveland gets nearly 25 robocalls a week. Sometimes the calls promise better credit card rates on cards she doesn’t have. Sometimes they’re threatening tax collections or lawsuits. Sometimes they’re selling something she doesn’t want.

She has trained herself not to answer calls on her cellphone from numbers she doesn’t recognize. She’ll wait to see whether there’s a message. But still, the calls are annoying.

“I’m angry someone is infringing on my day. There are only so many minutes in a day,” said Dew, 71. “It just seems like it’s escalating. I would just like it to stop.”

Dew and many others may soon get their wish.

Cleveland-area man has one of the highest credit scores in the entire country, 848 out of 850

Tom Pavelka has a nice 3,000-square-foot home in Westlake, a good government job, two British sports cars and an adoring wife of 25 years.

But he has one more thing that most people would really, really love to have: a credit score that is higher than almost everyone else’s in the country.

Pavelka, 56, has a credit score of 848 out of 850. The letter he got from the credit bureau recently said his score “ranks higher than 100 percent of U.S. consumers.”

That makes Pavelka a financial anomaly.

View Story

Would you let the IRS do your return? ‘Real-time tax system’ touted to fight fraud, tax evasion

Most of us grumble about filing our income tax returns every year. But what if the IRS instead prepared your return for you and just told you how much you owe or will get back?

It’s an idea that has been gaining momentum within the Internal Revenue Service as a way to thwart tax evasion and curb identity theft.

It’s called the “real-time tax system,” and here’s a look at how it would work.

View Story

Cleveland-area debit card fraud cases possible in part because photo IDs aren’t mandatory

Thieves cleaned out Santo and Jill Berardi’s Charter One checking account during a shopping spree that lasted six days and racked up $4,612 in purchases at more than a dozen stores.

“Here’s my question: Why didn’t anyone ever ask for the person’s ID?” said Santo Berardi, 52, of Middleburg Heights. “Why is it, when you’re anywhere around here, nobody ever asks for my ID? I think it’s a bunch of bull.”

The reason no one requires Berardi to show his ID is they can’t. The credit card companies say merchants can ask for photo identification, but they can’t require it.

View Story

Geico is taking a bite out of Progressive: It doesn’t take a caveman to know Mayfield’s insurance giant is in a battle

Some think Progressive’s brand is in trouble as it competes with Geico’s gecko and cavemen, Nationwide’s wacky “Life comes at you fast” commercials that are all over YouTube, and Allstate’s image of strength and trustworthiness pushed by spokesman Dennis Haysbert, the former president on the TV sensation “24.”

Progressive, one of Northeast Ohio’s largest employers with 9,000 workers and one of the area’s few remaining Fortune 500 companies, faces a cutthroat field of 300 competitors in the $150 billion-a-year auto insurance industry.

View Story

Three years after credit card reform, consumers save millions but see fewer rewards and more fees

February 14, 2013

It seems difficult to believe that, only a few years ago, credit card companies could change your interest rate any time they wanted or charge you a late fee if your payment arrived after sunrise on the due date.

They also could peddle credit cards to college students who had no income and could charge you fees if you wanted to pay your bill online or by phone.

How times have changed.

View Story

Experts say little can be done to keep attackers from slowing down websites; PNC is the latest bank hit

On a day when another large bank dealt with a cyberattack, banks and security experts said there’s little that can be done to prevent an assault on any website.

PNC Bank said Thursday that customers reported problems logging in to their accounts because the company’s site was bombarded with outside traffic aimed at causing a slowdown.

View Story

Click Here to View More.

My Christmas wish list: You should be able to block robocalls, get your credit score more easily, do your taxes more quickly

December 19, 2014

It’s time for my 10th annual “What I want for Christmas” list.

View Story

There’s a bit of a disconnect between me and AT&T

We usually use this space to talk about your problems and questions. But my boss thinks my latest problem is a riot. Maybe because it’s me, or because it took three months to resolve, or because of all of the times he heard me raise my voice.

So here, for your entertainment, is the tale of How AT&T Disconnected My Home Phone Line (and Took Months to Sort Out the Mess).

View Story

Five years ago, I thought the world as I knew it was ending

A look back at Sept. 29, 2008. It’s been five years since that ugly September week. And it really wasn’t about investment banks and derivatives and mortgage portfolios. It was about people enduring agonizing stress as lives changed.

View Story

The final days of the nation’s 7th-largest bank, National City, outlined in court documents

Everyone knows how the story ends: with National City’s sale to Midwest rival PNC Financial Services Group. What has never been told publicly is what really happened in the bank’s final agonizing weeks.

Some 3,000 pages of court documents, part of shareholders’ lawsuits over the sale, show that National City executives were terrified the bank could actually run out of money and fail.

View Story

Credit and debit cards with EMV chips mean big changes for consumers, shoppers nationwide

If you have a credit or debit card, shop in a store or eat in a restaurant, you’ll notice big changes in two months.

Oct. 1 is the deadline for banks to re-issue 1.2 billion credit and debit cards that are in circulation in the United States with new cards that contain fraud-resistant computer chips. And Oct. 1 is the deadline for retailers nationwide to upgrade 10 million card readers.

The changes are expected to eliminate about 40 percent of the credit and debit card fraud in this country. But the changes caused by those tiny computer chips will also mean you’ll have to use payment terminals differently, and this could lead to longer lines in stores and restaurants, probably for several months as consumers and companies adjust.

View Story

Alternative spending takes form of prepaid debit cards: Few local banks offer popular reloadables

As banks realize that more and more consumers want alternatives to traditional checking accounts and credit cards, nearly 60 percent of banks nationwide now offer prepaid gift cards or reloadable debit cards.

In some cases, these cards are an alternative for people who don’t want or can’t qualify for checking accounts or credit cards. In others, they’re purchased as gift cards by or for people who want spending they don’t have to track or get a bill for later.

View Story